How Much Life Insurance Do You Need?

Both the amount and cost may surprise you.

Calculating Your Coverage Need: The 10x Income Rule

A quick and common guideline is to aim for 10 times your annual income when determining life insurance coverage. But there's more to consider to truly meet your family’s needs.

While the 10x rule provides a straightforward estimate, your financial situation may involve other important factors. To ensure your family is fully protected, there are two solid concepts to consider. The first concept is the “DIME Method” (Debt, Income, Mortgage, Education), which gives you a more comprehensive approach to estimating the amount of coverage you need.

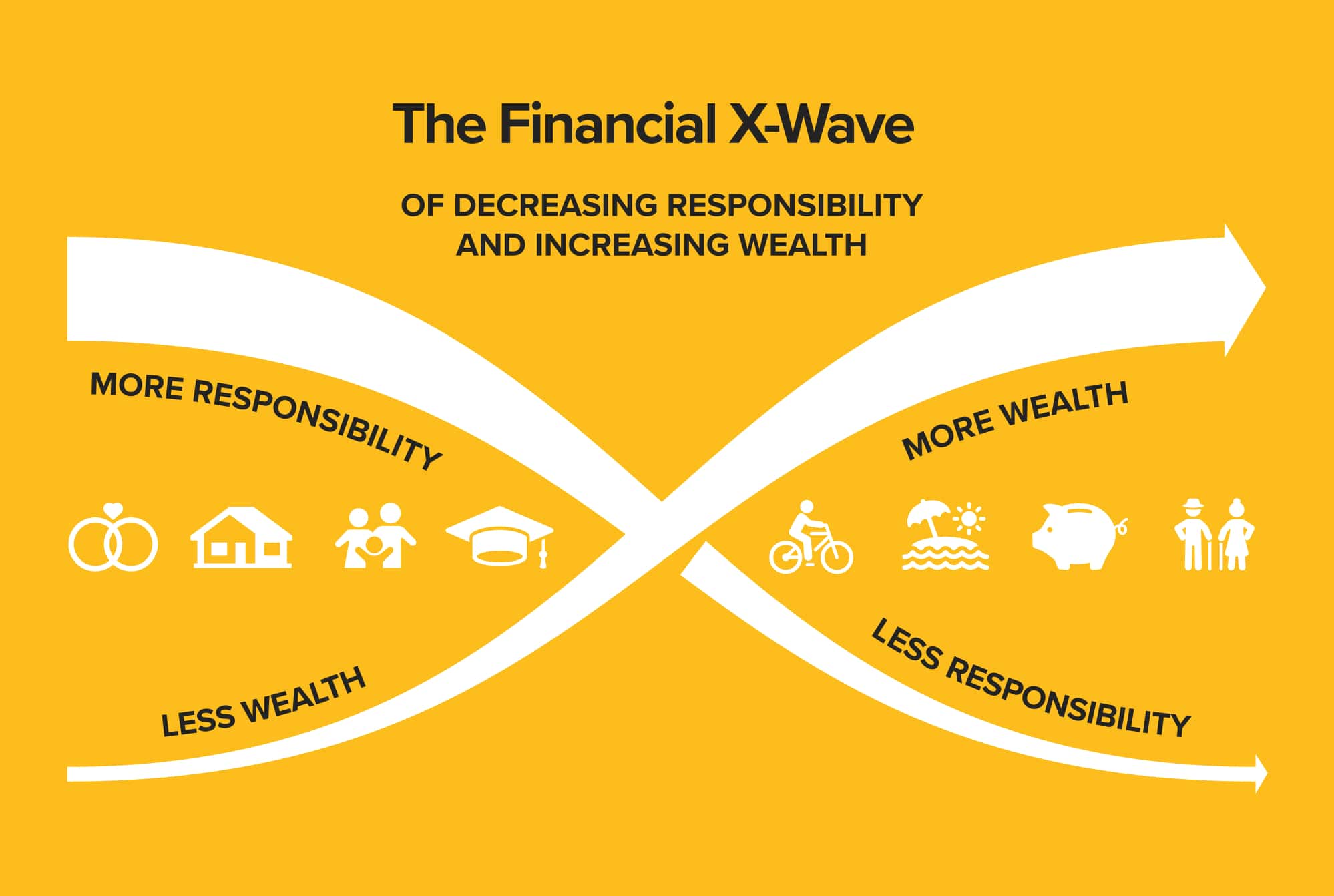

The second concept is called “Financial X-Wave,” which can help visualize how your insurance needs evolve throughout the different life stages.

Let’s look at both concepts...

Life insurance isn’t just a number—it’s about securing peace of mind and ensuring your family’s future is protected.”

Concept 1: The DIME Method

The DIME Method is a comprehensive way to calculate how much life insurance coverage you may need, based on these four key areas:

Debt

Add up all outstanding debts, such as credit cards, car loans, or personal loans, that your family would need to pay off.

Income

Multiply your annual income by 10 to replace your income for your family for at least 10 years.

Mortgage

Consider the remaining balance on your mortgage or rent. Life insurance should provide enough to cover this so your family can continue living in their home.

Education

Estimate future education costs for your children, whether for college or private school tuition.

Your Total Estimated Life Insurance Need

This method helps ensure that major financial obligations are covered, providing financial security for your loved ones.

Concept 2: The Financial X-Wave

Term life insurance is a powerful protection tool that provides coverage for a specified period, paying a death benefit to beneficiaries who can use the money to replace an income, pay off a mortgage, cover debts and funeral expenses, and avoid financial hardship.

This means...

Decreasing Responsibility

Over time, as debts are paid off, children grow up, and your mortgage decreases, your need for high coverage diminishes.The Sweet Spot for Term InsuranceIn the earlier stages of life, when responsibilities are highest—such as paying off debts, raising children, and managing a mortgage—term insurance offers a cost-effective way to cover those larger financial obligations. Term life insurance is ideal for providing significant coverage during this period of greater responsibility.

Increasing WealthAs your wealth grows through savings and investments, you may need less life insurance coverage, but it’s important to have enough protection during key life stages.

Adjusting your life insurance as your financial situation evolves ensures that you remain properly covered.

Long-Term Protection: Leaving a Legacy

Estate Taxes and Probate FeesUpon your passing, your estate may be subject to taxes and probate fees, which can reduce the amount passed on to your heirs. Life insurance can help cover these costs, ensuring your loved ones receive their inheritance without financial burden.

Leaving a LegacyLife insurance can provide a way to leave a lasting legacy for your family, loved ones, or even charitable organizations. It allows you to pass on wealth, support causes you care about, and leave a financial impact that extends beyond your lifetime.

Final ExpensesThe cost of final expenses such as funerals, medical bills, and outstanding debts can add up. Maintaining adequate coverage ensures these costs don’t fall on your family.

By considering long-term needs such as estate planning and legacy building, you can ensure that your life insurance not only protects your family today but also secures their future and preserves your legacy.

Make sure your family is fully protected.

By using tools like the DIME Method to calculate your coverage and the Financial X-Wave to visualize your evolving needs, you can ensure that your family is financially secure at every life stage. However, life insurance is just one part of a larger financial strategy.

It's essential to work with your financial professional to go through the 7 Money Milestones, which cover every aspect of financial preparedness—from emergency savings to debt elimination, proper protection, and building wealth. Ensuring you're fully prepared in all areas will give you and your family the peace of mind that you're financially secure for the future.

Can you use your life insurance while you’re still alive?

We couldn’t have said it better.

If you’re overpaying for term life insurance, you can be sure your current provider doesn’t want you to know about our Savings/Benefit Calculator.

Find your better deal today!

Shop Your Term