Our Mission

To bring pricing transparency to the process of buying term life insurance.

An Industry in Desperate

Need of Transparency

Many financial professionals and online providers only show one price—their price–as they lead consumers through the term life insurance buying process.

The problem with this is that term life insurance products from most providers are essentially the same. Their pricing, however, can vary significantly. When only one option is presented, consumers can make the costly financial mistake of overpaying. Their overpayments can add up to thousands of dollars, which could be for other important financial needs or a term policy with a higher death benefit at the same monthly premium.

The overpayment on a term life insurance policy belongs in the control of the consumer, not in the wallet of their financial professional or insurance company.

The Solution: Pricing Transparency

During the process of buying term life insurance, every consumer should have the right to view the rates from other companies to evaluate and calculate the best choice for them and their family. Informed decision making serves and protects the consumer.

The 3 Components of Our Competitor Pricing Transparency Solution

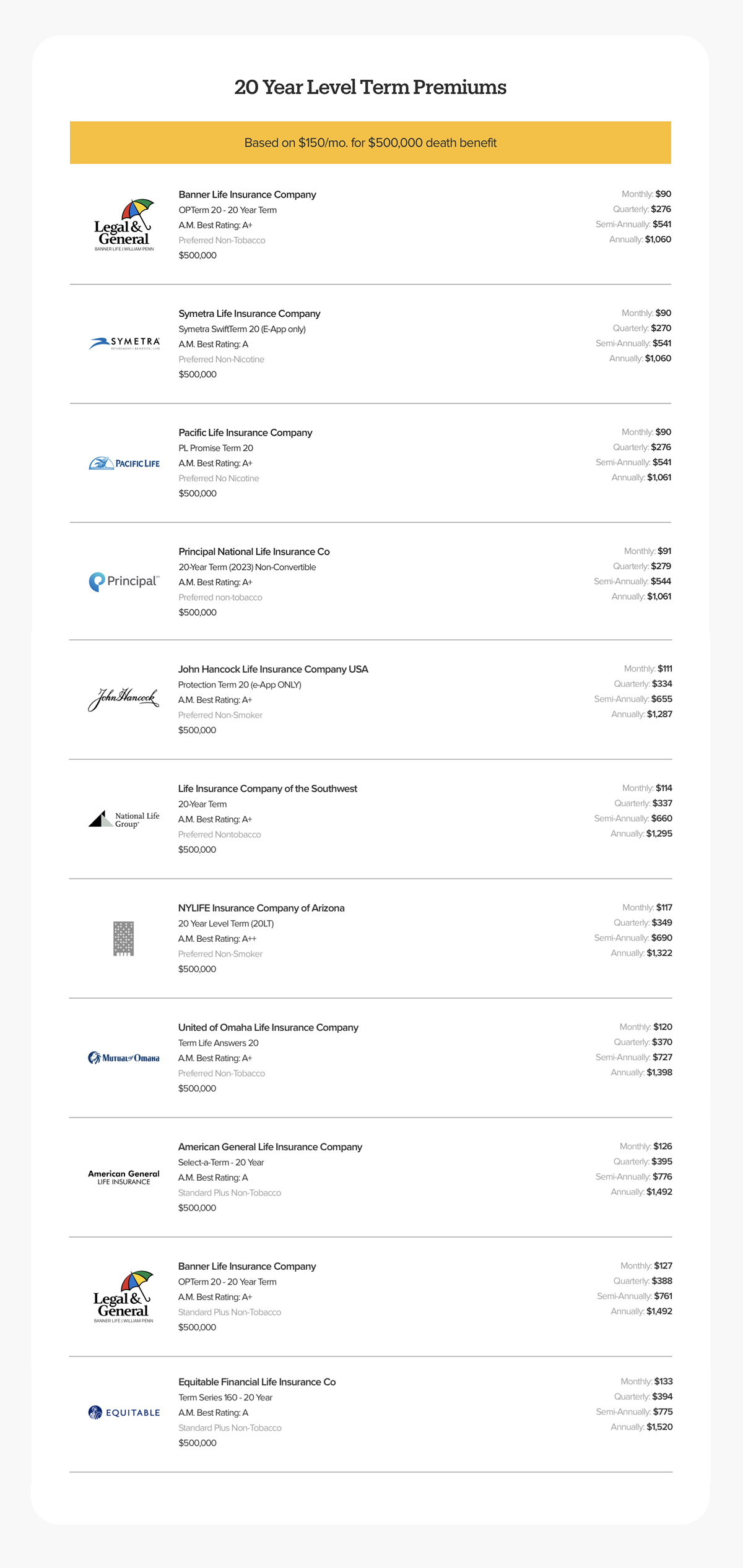

Custom Price Quotes

A listing of company rates all based on the consumer’s insurance need and basic, non-personal information.

Premium Savings Potential

The amount the consumer could save by switch from their existing term policy to a lower priced option from competitor rates.

Benefit Increase Potential

The additional death benefit the consumer could gain by switching to a policy with the same monthly premium as their existing policy.

Custom Price Quotes

Whether you currently have a term life insurance policy or are about to purchase one, everyone should have the opportunity to review rate quotes from other companies that offer the same product.

Our custom price quotes offer:

List of rates from other companies based on your data

Ratings for each company listed

Top 3 most expensive options

Top 3 least expensive options

“Insurance industry sales data1 compared with rates from top insurance providers2 reveal that millions of consumers are overpaying for term life insurance each year.”

1 This data is derived from Compulife API rate comparisons run on October 22, 2024, indicating that top-selling companies often offer more expensive policies.

2 The providers are sourced from the ShopYourTerm Savings/Value Calculator, which compares rates across multiple insurance providers.

Coverage Increase Potential

Another feature of our Savings/Benefit Calculator is to see how much more comprehensive term life insurance coverage could you get for the same monthly premium amount you have now. This means getting more protection for your family without impacting your monthly budget.

Potential benefits of getting more benefit:

Significant savings over time

Apply savings toward short-term monthly needs

Invest savings into long-term retirement goals

Create cash flow to pay off debt

Build up your emergency fund

Same monthly premium. More life insurance. It’s a no-brainer.

With more coverage, there are so many things families could do with that extra benefit to reduce hardship, stay on track financially, and thrive.

Mortgage Payoff

Funeral Expenses

Income Replacement for Home Maker Parent

Car Loan Payoff

Wedding Costs

Special Needs Children Expenses

College Tuition

Day-to-Day Living

Expenses

Medical Costs

When it comes to these important expenses, every dollar of your life insurance counts.

“Our mission is about fairness, information, and education—all of which should be rights of the consumer. Let me know if you’d like to ShopYourTerm™ to save more and get more for your family.”

– Aja Williams, Financial Professional

The purpose of human life is to serve, and to show compassion and the will to help others.

— Albert Schweitzer

We couldn’t have said it better.

If you’re overpaying for term life insurance, you can be sure your current provider doesn’t want you to know about our Savings/Benefit Calculator.

Find your better deal today!

Shop Your Term